This post is an excerpt from the Q2 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

The U.S. imports 14 billion board feet (BBFT) of lumber net of exports, primarily from Canada (12 BBFT). Given proposed tariffs by the Trump Administration, how feasible is it for the U.S. to increase softwood lumber production to replace Canadian lumber imports? To start, at least three things must be considered: access to sustainable timber supplies, readiness of sawmill capacity, and availability of sufficient labor.

Timber Supply

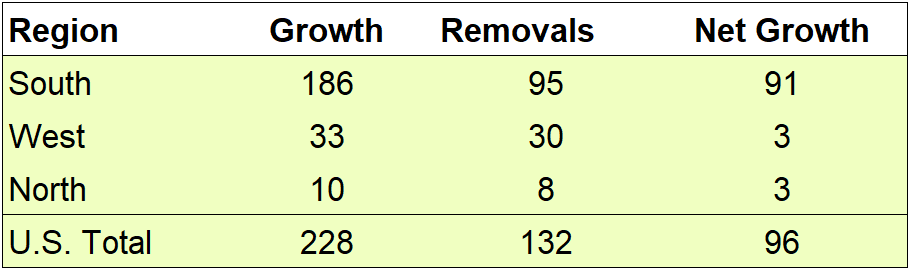

According to data from the U.S. Forest Service, the U.S. has enough timber raw material to replace Canadian lumber. The figure below shows annual growth (the increase in wood volume annually from standing trees) and annual removals (how much is harvested) from privately-owned timberlands. Net growth shows how much additional wood grows every year on top of what is removed. This “net” growth of softwood sawtimber on private timberlands was 96 million tons per year, largely in the U.S. South, as of 2020.

Data Source: U.S. Forest Service FIA, 2019/2020 data

To replace the 12 BBFT of lumber that the U.S. imports from Canada, mills would need to buy roughly 50 million tons of wood (logs) per year. In theory, the U.S. South alone grows enough wood annually to support this. For comparison, the South added nearly 11 BBFT of softwood sawmill capacity from 2009 – 2024, which would be a similar level to replace lumber imports from Canada.

Hurdles: Mills and Labor

While U.S. private forestland owners grow enough wood to support this level of production, several hurdles remain before the lumber can reach markets. These include the capability to move lumber on rail from the U.S. South to other parts of the country, allocating the capital required to build new sawmill facilities and expansions, accessing the equipment required for these plants, and shortages in the labor force needed to build, supply, and run these facilities. Critically, constraints, especially those related to labor and logistics, affect the forest industry today. And when tariffs and end markets are uncertain due to changing policies, firms are reluctant to invest the capital needed to solve these problems.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply