Softwood lumber producers had a wild ride in 2020. From major cutbacks in the spring in response to the COVID-19 pandemic to pushing production limits in the fall to capture record high lumber prices, mill operators made many short-term adjustments. In addition, firms continued capital projects and rationalized capacity across the U.S. and Canada. Forisk published a list of the top 10 softwood lumber producers in the U.S. in 2017 and published an update in 2019. Who are the top softwood lumber producers in the U.S. today?

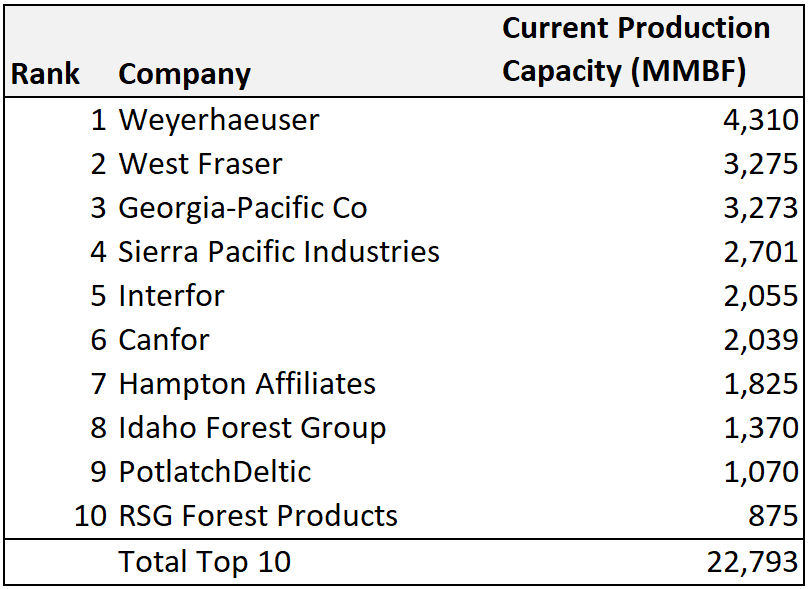

Weyerhaeuser ranks number one for lumber production capacity, followed by West Fraser. The top 10 U.S. softwood lumber producers have the capacity to produce 22.8 billion board feet of lumber. This represents over half (52%) of the total softwood lumber production capacity in the U.S. Capacity of the top 10 firms increased by 3.9 billion board feet since we published the top 10 list in 2017 and increased by nearly 0.5 billion board feet since the top 10 list update in 2019.

Georgia-Pacific made the most changes since last year, including opening the greenfield mill in Albany, Georgia and starting up the mill rebuild at Warrenton, Georgia. The company moved to #3 on the list, up from #4 last year. GP also idled the mill in Dequincy, Louisiana. Interfor sold the sawmill in Gilchrist, Oregon to Neiman Enterprises, reducing Interfor’s U.S. capacity.

The Forisk Research Quarterly publishes analysis of the softwood lumber sector in North America and capital investment trends. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hclark@forisk.com for pricing information and to place an order.

Leave a Reply