This post includes data from featured research in the Q2 2016 Forisk Research Quarterly (FRQ).

Timberland investors looking to acquire assets and timber REITs seeking to grow their asset bases both made big moves over the past 16 months. Firms in Forisk’s North American Timberland Owner & Manager List were among those that conducted at least 92 publicly known timberland transactions totaling over 9.8 million acres between Q1 2015 and April 2016. This includes 29 transactions over this time frame that exceeded 20,000 acres each.

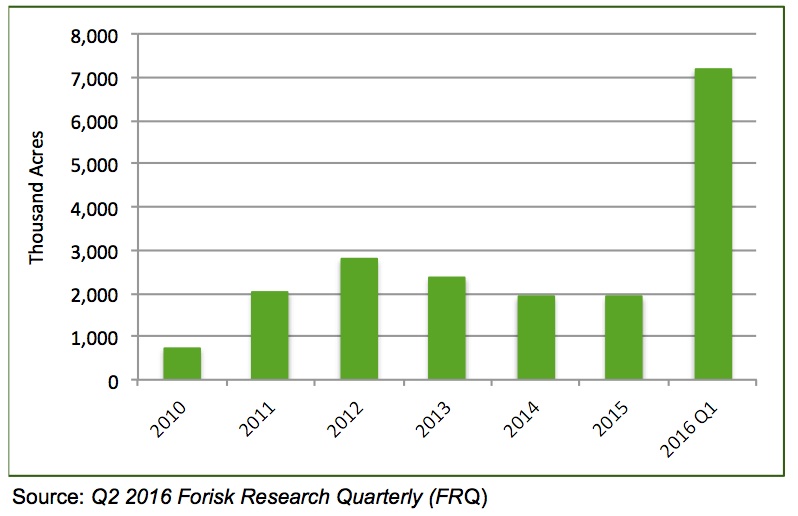

The figure below highlights how timberland transaction volume over the past five years leading to 2016 rose to levels more in line with pre-Recession markets. From 2011 through 2015, large-acre, publicly announced deals averaged 2.2 million acres and 52 closings in the U.S. annually.

Timberland Transaction Volume in Acres by Year, 2010-Q1 2016

Each year seemed to have a “signature” transaction as the market probed its way forward. In 2012, Hancock Timber Resource Group and Molpus acquired 1.9 million acres from Forest Capital Partners, closing out Forest Capital’s work in transferring Boise Cascade’s timberlands to the institutional investment sector. In 2013, Weyerhaeuser acquired 645,000 acres from Longview Timber (Brookfield) in the Pacific Northwest, recapturing the acres within a public REIT that had once traded as a standalone public REIT (in 2006). In 2014, JWTR sold 600,000 acres in Oregon to Green Diamond. And 2015 opened and closed with a series of robust transactions starting with the Q1 197,000-acre sale in Oregon by Cascade Timberlands to Singapore-based Whitefish Cascades Forest Products and ending with four Q4 100,000+ acre transactions involving firms such as Lyme, Campbell Global, Hancock, and Molpus.

In conclusion, the primary changes since Q1 2015 center on the public REITs. Acquisitions, divestitures and statements by public firms highlight efforts to look forward and allocate capital in ways that optimize their portfolios and shareholders. Overall, the sector continues its efforts to optimize timberland portfolios in a mature, competitive and increasingly transparent North American market.

Forisk’s timberland owner and manager research supports analysis of wood markets, timber prices, and forestry investments. To learn more, click here or call 770.725.8447.

Is the large transaction in 2016 the Plum Creek to Weyerhaeuser merger?

Yes, exactly. The merger accounts for most of those acres.