This post includes an excerpt from research published in the Q3 2017 Forisk Research Quarterly (FRQ).

Pine sawtimber stumpage prices in the South bottomed in 2012. Despite modest recovery through 2015, prices dropped the past two years. While timber price models predicted recovery, they consistently proved optimistic. Forisk timber price models apply demand and supply drivers. While demand leads our projections, changes in supply can dampen or accelerate price growth. During the slow recovery, the forest continued to grow and our modeling indicates that many (most) timber markets across the region are well or oversupplied in pine sawtimber. Since 2012, lumber production in the South increased, which implies increased use of pine sawtimber.

The use of pine sawtimber, in tons, directly relates to another factor: sawmill efficiency. Lumber producers across the South have invested in new equipment – such as continuous dry kilns (CDKs) – to increase capacity and efficiency. In fact, 90 CDKs have been installed in North America, and many in the past 5 years. An increase in efficiency, or an increase in the amount of lumber produced from the same volume of wood, implies lower levels of wood demand. Forisk tracking indicates that South-wide average yields of one thousand board feet (MBF) per 4.6 tons or less are the norm on a volume/weight basis. As the sector continues to consolidate, we expect average yields to improve as firms upgrade mills.

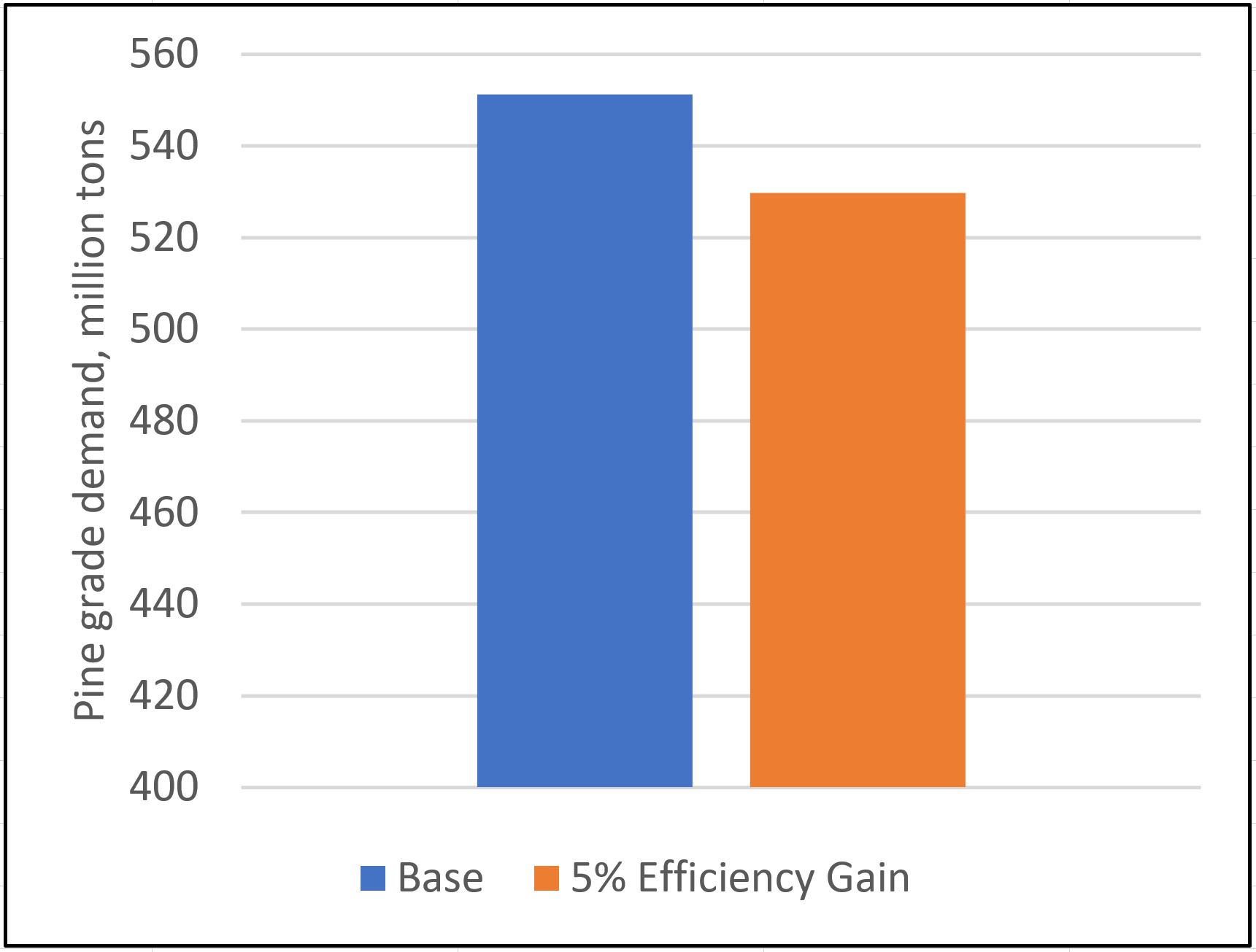

Forisk tested how a 5% increase in sawmill efficiency in the South could affect timber prices. We modeled a Base case, our view of the “most likely” scenario that accounts for macroeconomic trends, wood demand, and forest supplies. Then, we modeled the Base Case with a 5% sawmill efficiency gain, starting with a 3% gain in 2017 and the full 5% gain in 2018. This level of efficiency improvement would reduce wood demand by 22 million tons over the next 5 years in the South relative to baseline projections. The effects of this further reduces upward pressure on prices. See the full discussion of price impacts in the Q3 2017 issue of the Forisk Research Quarterly.

Sawmill efficiency remains a research topic for Forisk. A key question is the level to which the sector has already captured these gains versus expected improvements in the future. We are currently testing our price forecast models to better account for increases in efficiency in our Base Case and standard models.

Leave a Reply