This is not your Grandma’s pulp mill.

Within the forest products industry, the ability to use and leverage technology can distinguish firms within a sector, while clearly separating the ability to generate wealth across sectors. For example, the pulp paper sector stands out for its outsized (1) need for capital and (2) ability to create value from technology investments that improve facilities or lead to new products. And as major users of wood, individual pulp mills serve as strategic factors for timberland investors screening timber markets and in the plans of sawmills looking to expand capacity in wood baskets where they can sell their manufacturing residuals (e.g. chips for pulp).

Our previous Forisk Strategy Note shared specific learnings related to the threats and opportunities associated with substitutes in the forest product industry based on research related to North America’s structural panels sector. This post shares an excerpt from our current Note, which reviews the pulp and paper sector to better understand the role and influence of technology in the forest industry, and the potential for both incremental and massive levels of innovation.

North American Pulp and Paper Sector

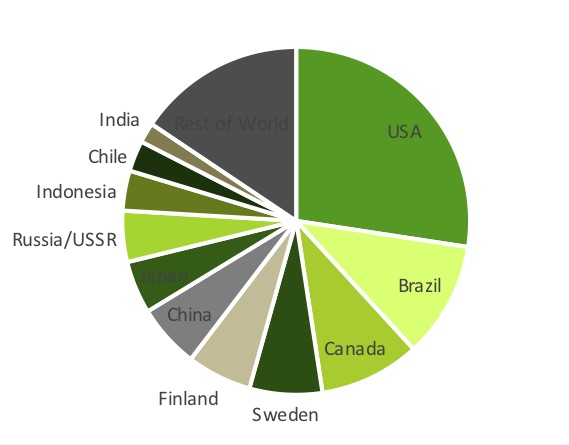

North America’s paper industry from 50 years ago has since updated, shifted and rationalized. While total production peaked in 1999 before dropping 25%, trends and advances diverge across individual sectors. Packaging, which accounts for 65% of total paper and paperboard production, and household and sanitary products are up, while printing and writing paper and newsprint contracted. Despite declining production, North America (37% of global production) among continents and the U.S. (27%) across countries remain the top wood pulp producers in the world (Figure A).

Figure A. Top Wood Pulp Producing Countries

Sources: UN FAO; Q3 2019 Forisk Research Quarterly (FRQ)

Observations from Pulp and Paper on Technology

Paper and paper products have directly applicable and tangible roles in our daily lives. As Gary Smook wrote nearly two decades ago in “Handbook for Pulp and Paper Technologists”, paper and packaging have distinct and unique roles for capturing and sharing information, for packaging goods, and for basic sanitation. And producers of these products, to survive and profit, travel a road of constant innovation. What implications do we observe from the use and application of technology in the pulp sector?

One: Investments in Technology Allow and Require Scale and Consolidation

The economics of pulp and paper differ materially from the rest of the forest industry. The superior margins and ability-to-pay relative to lumber, panels and pellets create a pecking order, reinforced by the fact that wood raw materials account for a smaller portion of pulp mill total manufacturing cost.

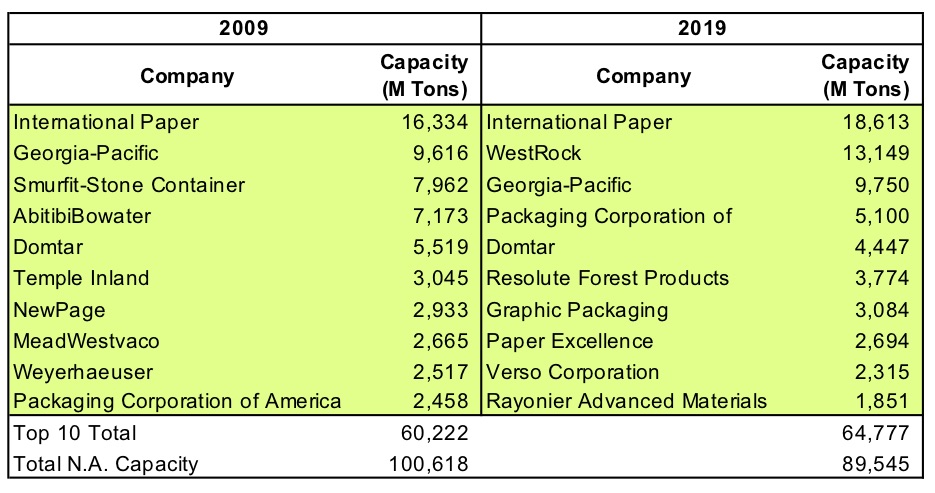

However, ownership in the pulp and paper industry requires capital and technology. Between 2009 and 2019, the number of pulp mills in North America decreased by 16% while average pulp mill capacity increased 6% (source: North American Forest Market & Industry Rankings, 2019 Forisk Multi-Client Study). Pulp firms seek to lower their per unit manufacturing costs by scaling up facilities with better technology and faster, more efficient machines, and this requires increasing committed capital.

In a world of budget constraints, bigger capital commitments necessitate choices. In the pulp and paper industry, choices manifest themselves through efforts to focus on and consolidate product lines. In North America, only four of the ten largest pulp producers in 2009 remain on the list in 2019, as companies have since merged and restructured (Figure B). The top ten producers increased from 60 million tons of capacity in 2009 (60% of North America’s total) to around 65 million tons in 2019 (72%). Currently, the top three firms alone represent 46% of total capacity. And all firms on the current list deployed capital to upgrade machines and technology over the past decade.

Figure B. Top Ten North American Pulp Producers, 2009-2019

Data source: Forisk North American Forest Industry Database

For those interested in a day dedicated to sharing and discussing research and insights related to forest industry operations and investments, register for Wood Flows & Cash Flows, Forisk’s annual conference on December 5thin Atlanta. Executive Panelists will address threats and risks to the forest industry.

Interesting. Just a note: USSR is “no more” for over 25 years (28 to be precise) – Figure A. FAOSTAT has the latest data on Russian Federation alone (2018). The only other two countries of the former USSR that produce Wood Pulp, Estonia and Belarus, produce it in very small quantities and are not worth combining with Russian Federation for the sake of “USSR”.

Amazing write-up with great information. I think your post will teach us more about how to make use of Technology in Forest Industry.