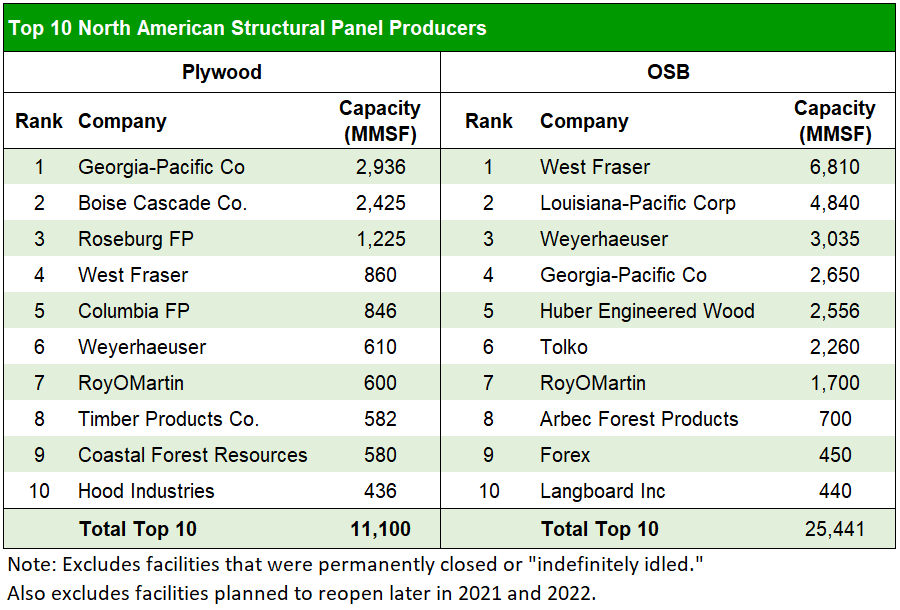

West Fraser closed on the purchase of Norbord on February 1, 2021, becoming the largest producer of OSB in North America. The OSB sector is heavily consolidated, with the top 10 firms accounting for 100% of OSB production in North America. The plywood sector, while more diversified, is 60% of the size of the OSB sector. West Fraser makes the top 10 plywood list at #4. Georgia-Pacific tops the plywood list at #1 and sits at #4 on the top OSB list.

OSB capacity continues to come online to feed strong demand from the housing sector and in response to recent strong OSB prices. The former Norbord Chambord OSB mill (now owned by West Fraser) is slated to reopen this year. Louisiana-Pacific plans to restart the idled Peace Valley, BC OSB mill in 2022. In addition, Louisiana-Pacific is investing more into its siding business and plans to convert the Houlton, Maine engineered wood products facility to siding by 2022 date, with a conversion planned next for the Sagola, Michigan OSB plant to siding.

The Forisk Research Quarterly publishes analysis of the structural panels sector in North America and capital investment trends. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hclark@forisk.com for pricing information and to place an order.

Leave a Reply