Last week, Forisk published the June 2021 edition of the Forisk Market Bulletin in which our team communicated with over 170 forest industry professionals in the U.S., Canada, and Europe on topics including break-even analysis for forest carbon markets and capital investments across the forest products industry. And while North America’s forest industry demonstrated “discipline” over the past decade with capacity expansions, and recently strengthened their balance sheets (reduced debt) with the profits from building products sales, executives still feel the need to put available capital to work. North America added 1.4 billion board feet of sawmill capacity in the past 12 months, with another 1.6 BBFT of capacity coming online in H2 2021. A significant amount of softwood sawmill cap ex is in the queue. (Note Canfor’s recently confirmed plans for a new 250 MMBF mill in Louisiana to open Q3 2022).

Pulp and paper mills continue to evolve. Markets for pulpwood are strong for mills producing containerboard products. As one contact put it, “there is a big sucking sound around here right now” as healthy pulp mills in competitive Southern markets buy available pulpwood and wood chips. Other markets, alternately, are losing mills: The Park Falls Development mill in Wisconsin shut down in March, and Paper Excellence announced the permanent closure of the idled Mackenzie mill in British Columbia due, in part, to a shortage of fiber. M&A activity continues in the sector, with the announcement by Paper Excellence to acquire Domtar in a transaction valued at $3.0 billion.

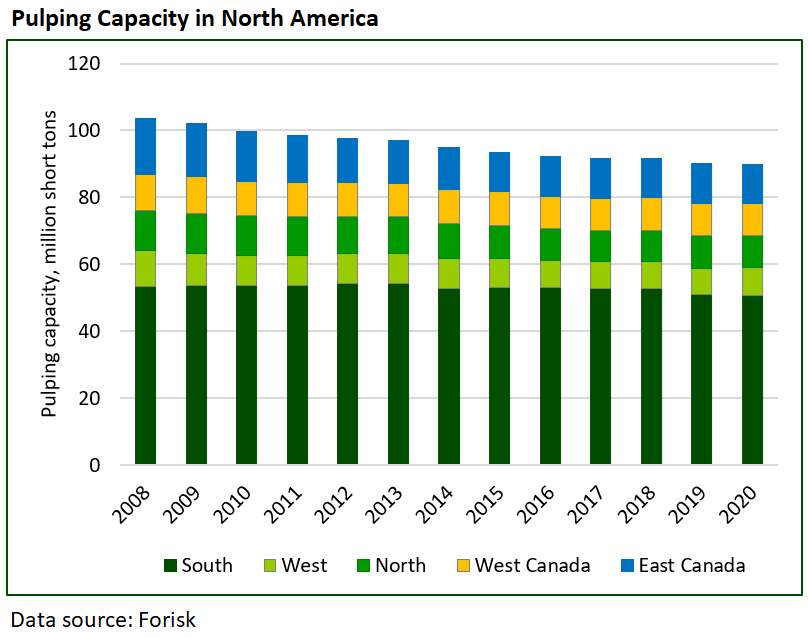

Pulp mill capacity in North America declined 13% in the past twelve years. Over this time frame, Eastern Canada lost the most capacity (32%), followed by the West and the North. The U.S. South has the largest share of pulping capacity at 55% and has been the steadiest region, shedding only 5% over this period.

For details on recent mill investments and timberland transactions, subscribe to the Forisk Market Bulletin. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hclark@forisk.com for pricing information and to place an order.

Leave a Reply