We joke that, “hardwood markets are hard” when it comes to wood procurement and market analysis. Hardwood procurement involves scavenging timber from landowners with varying objectives and timber management approaches and on landscapes with wetter ground than most pine plantations. Analysis of hardwood mills and markets is difficult as the mills are often smaller than softwood mills and owned by more private companies, families, and individuals than the larger softwood mills owned by corporations.

Forisk tracks over 2,200 forest industry mills to publish the North American Forest Industry Capacity Database (“Mill Database”). We expanded our coverage of the hardwood sawmill sector in Q4 2022 to include mills down to 5 MMBF in size (expanded from the previous 10 MMBF cut-off). The expansion added 257 hardwood sawmills and over 1.4 BBF of capacity to the deliverable database.

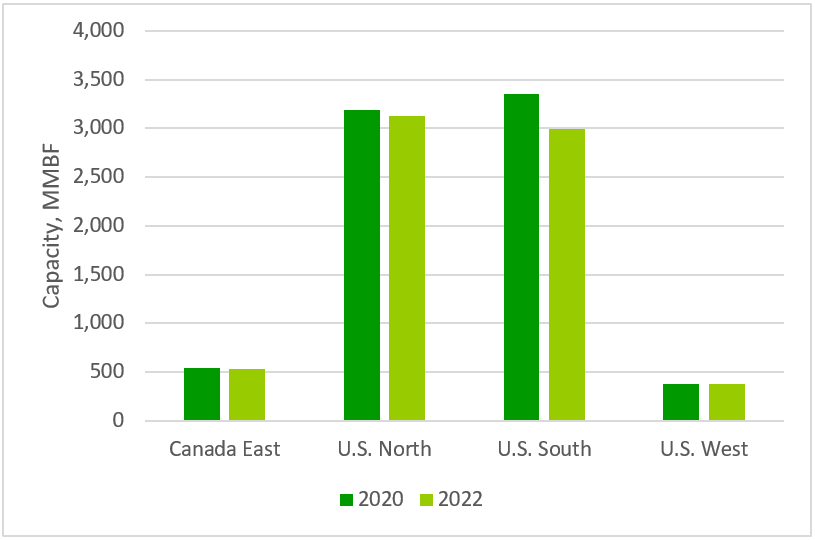

Hardwood sawmills in the Mill Database have the capacity to produce 7.0 BBFT of lumber annually. The U.S. North leads with 3.1 BBFT, followed by the U.S. South. East Canada and the U.S. West make up the balance. The average size of a hardwood sawmill is 14 MMBF (this includes facilities that also mill some softwood). Hardwood lumber capacity declined by 6% from 2020 to 2022 due to mills closing or switching to use more softwood. Most of the decline was in the U.S. South where mills shifted towards softwood species and expanding the capacity of mills to use pine timber, which is less expensive and easier to procure.

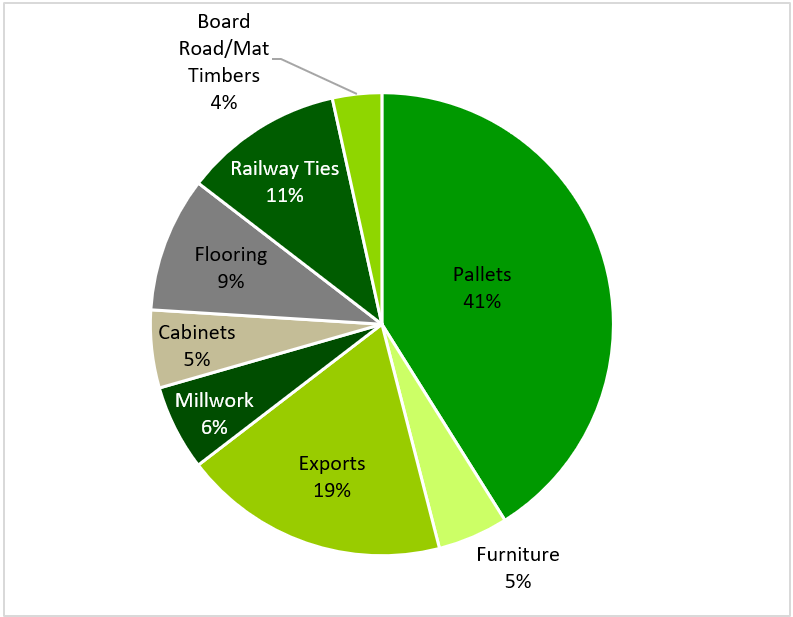

According to the Hardwood Market Report, pallets for shipping accounted for 42% of U.S. hardwood lumber consumption in 2021. Significant volume also flows to export markets (19%) and railway ties (11%). Construction uses (flooring, cabinets, and millwork) together accounted for 16% of hardwood lumber consumption.

Although hardwood markets can be difficult to analyze, they remain important to timberland owners in local wood baskets and provide essential products to the shipping, railroad, and construction industries. We continue to watch this industry evolve and respond to timber supply constraints, dynamic markets, and opportunities.

To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Thank you for exploring this often overlooked segment bin our industry. Please keep this on your radar for future articles.