This blog includes data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber markets. For more information, please visit www.forisk.com.

The paper and packaging slowdown has reached into a third consecutive quarter and has contributed to falling wood fiber prices across much of North America in Q2 2023. Inflation cooled consumer demand for goods, and paper mills have drawn down finished goods inventories to match current demand levels. U.S. roundwood and chip prices both fell around 1% year-over-year.

Through early 2023, paper mill closures across North America trimmed production capacity in response to the slowdown. According to the Forisk Wood Fiber Review, fiber prices in most regions trended down, unlike the wide range of regional differences just months ago. In this blog, we focus on the market dynamics in the U.S. North, West, and Lake States.

Pulp and Paper Mills: Wood Price Drivers Across the Country

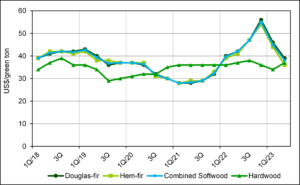

Historically high wood fiber prices in the Northwest and Northeast U.S. dipped over 10% for the quarter. In the U.S., only the Lake States reported higher softwood fiber prices, as western Canadian prices inched higher as well. Hardwood prices increased in both the Lake States and the U.S. Northwest.

Fierce competition for fiber in the U.S. Northeast drove prices higher in 2022. The story flipped this quarter in rapid fashion with loggers being put on quotas as mills slowed operations. Prices dropped as much as 32% this quarter in response and fears renewed of additional logging capacity losses, the major constraint pushing prices higher last year. In the Lake States, prices continued higher as a late winter freeze pushed consumers to extend procurement distances in search of fiber.

The pulp and paper slowdown impacted Northwest U.S. markets as well. Inventories swelled and prices dropped 10% or more for all products except hardwood logs. Poor markets resulted in several mill closures in the region, including tissue converting operations at two Cascade facilities in Oregon and the idling of Packaging Corporation of America’s Wallula, WA facility.

In the Pacific Northwest, poor pulp and paper markets coupled with high mill inventories are making it difficult for many suppliers to remain healthy. For fiber suppliers, diversification and flexibility in their businesses continues to be valuable. Softwood prices decreased across the board, with product mix (Douglas fir, hem-fir, and mixed softwood) prices dropping more than 15%. Prices in a few sub-regions remain higher year-over-year.

Leave a Reply