We have been getting questions from clients about pulp markets as pulpmills across the country cut back production and wood purchases. Stephen Wright, the Product Manager of Forisk’s Wood Fiber Review, discussed market trends with procurement managers and timberland owners in the U.S. South this month. According to Stephen, mills are running at reduced rates prior to the spring outage season. Several mills took extended outages due to market conditions, and new facilities that came online are operating below capacity. Even in traditionally strong pulpwood markets, suppliers noted struggles with low quota. One timberland owner noted, “Markets have taken a tumble, with mills slowing down production. Thinning is almost becoming a silvicultural treatment.”

Vickie Swanton, Forisk’s Western Region Representative, talked with procurement managers in the West and Lake States about market trends. Vickie noted that some mills in these regions are running shorter weekly shifts (4 days on, 3 days off). Other companies had longer outages; for example, they may run the mill for two weeks, then shut down for ten days.

Pulp/paper Production

What is driving the pulpmill slowdown? We published the Q2 issue of the Forisk Research Quarterly earlier this month, including updated pulp and paper production data from AF&PA. Paper and paperboard production dropped 9% year-over-year in the first quarter of this year. Printing and writing paper production dropped 16% year-over-year, and it dropped 9% last quarter. Newsprint production continued a slow, steady decline, down 4.3% year-over-year and 3% for the quarter. One of the big changes recently is the decline in packaging production. Packaging production slowed in September 2022 and is 9% below year-ago production levels despite a 3% increase over Q4 2022. Tissue production also fell year-over-year by 2%, despite a 1% rise from Q4.

Pulpmill Capacity and Locations

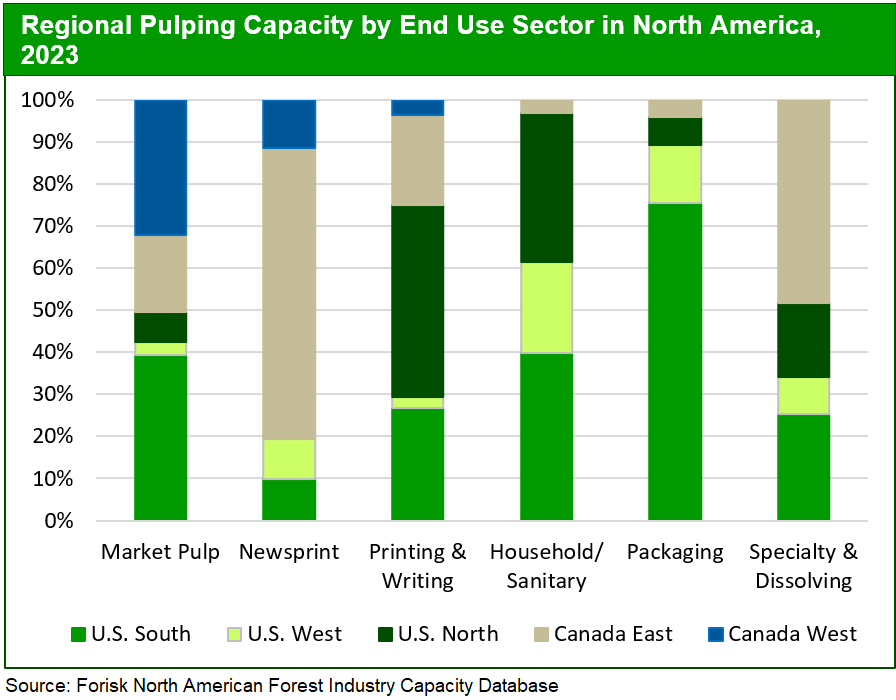

The packaging decline is meaningful as packaging makes up 73% of pulp/paper mill capacity in North America, according to Forisk’s North American Forest Industry Capacity Database. In addition, 76% of the packaging mill capacity is located in the U.S. South. The slowdown in the sector is impacting mills and forest owners in the South more than other declining sectors like newsprint and printing and writing papers, which are more concentrated in eastern Canada and the U.S. North. The dip in packaging production also hits the Pacific Northwest, as packaging accounts for 78% of mill capacity in the region.

Market Drivers

In the Q1 2023 investor presentations, company leaders at IP and WestRock cited market factors, including high inflation, reduced demand, and destocking, as drivers for soft markets. Customers are purchasing fewer goods given high prices and inflation. Also, many businesses increased inventories after the pandemic to hedge against uncertain supply chains. Now, these businesses are reducing inventories, particularly given lower consumer demand and improved supply chains. Export markets are also down.

Several paper mills announced closures. Evergreen Packaging announced the closure of their Canton, NC pulp and paper mill. WestRock stated that it will close the North Charleston, SC paper mill in Q3 2023 and exit the unbleached saturating kraft paper business. In Western Canada, Canfor will not reopen the curtailed Taylor, BC mill. In other mill news, Nine Dragons Paper in Biron, Wisconsin completed its multi-year conversion to all recycled feedstocks.

How long will this last? We partner with ERA to forecast paper and paperboard production in the U.S. We expect continued declines in newsprint and printing/writing papers, but we predict that demand will increase for packaging and household/sanitary products long-term. Current low demand levels will likely be short-lived and improve later this year, once businesses deplete high inventory levels…assuming the economy holds.

For details on mill capacity and to produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. To track pulpwood and biomass markets, consider subscribing to the Forisk Wood Fiber Review. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Timber owners recognize the importance of thinning but getting someone to thin is an increasingly difficult effort! Is there any guidance on how to solve this issue.

I work for a large bleach board mill in VA we still are slow with one paper machine idleled as well as folks on layoff as we go into the new year