This post is the first in a series related to the Q3 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis, timber price projections, and featured research on scenarios for forecasting timber prices. It provides an excerpt from the lumber chapter, authored by Pat Jolley and Amanda Lang.

Mass Timber– including glulam and cross laminated timber (CLT) – is still a developing forest industry sector in North America. It promises carbon storage and green architecture for builders and tenants, a new market for lumber for manufacturers, and beautiful aesthetics. According to Woodworks, 1,753 mass timber projects were built or in development as of March 2023. Many, however, import prebuilt mass timber materials from outside of North America due to the lack of current mass timber capacity. The Ascent Towers in Milwaukee, now the tallest mass timber building worldwide, was built with mass timber panels shipped from Austria. As the industry matures, project developers are building supply chains and firms are adding manufacturing capacity.

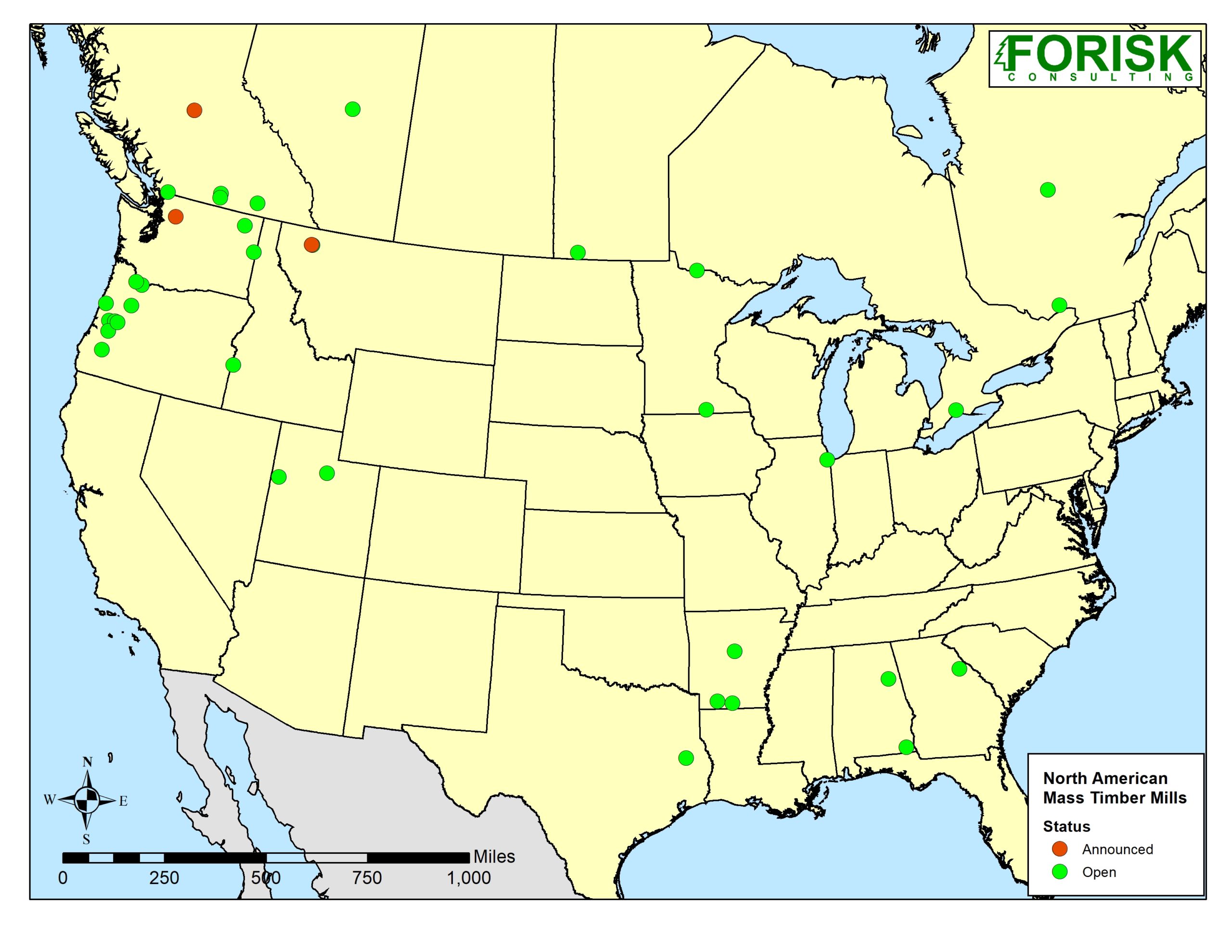

Mass Timber Mills

Forisk tracks 38 mass timber production facilities in the U.S. and Canada in the North American Forest Industry Capacity Database, including 24 that can produce CLT. Since 2017, Forisk tracked almost $793 million dollars of announced mass timber investments. The production capacity of mass timber in North America is over 62 million cubic feet, with announced expansions that bring the total to almost 67 million cubic feet by 2024. At full capacity, these facilities could use 1.4 BBF of lumber, equivalent to 2.4% of total North American lumber production for 2022 as reported by WWPA, although we note that most of these facilities operate below capacity. The U.S. West has the largest installed capacity with 51% located in the region followed by the U.S. South at 24% and the U.S North at 4%. Mass timber capacities for West Canada and East Canada are 10% and 11%, respectively.

Recent investments include Mercer’s purchase of Structurelam in British Columbia and Arkansas for over $81 million, making Mercer the largest mass timber producer in North America. Massive Canada plans to build a CLT mill in Williams Lake, British Columbia with estimated cost of $75 million. Smartlam is adding a glulam facility to the Dothan, AL footprint at an estimated cost of $62 million. Kalesnikoff plans to add two CNC routing machines for billet fabrication to the South Slocan, British Columbia mill.

Mass Timber Building Projects

Several mass timber buildings are in development in the U.S., including Walmart’s new headquarters, the Portland International Airport roof, and Jamestown’s 619 Ponce redevelopment. Walmart is expected to use 1.7 million cubic feet of Arkansas timber for the construction of the Bentonville, AR headquarters, to be completed in 2025. The $2 billion Portland International Airport makeover includes a mass timber roof that is 392,000 square feet in size utilizing nearly 400 glulam beams and 14 football field-sized roof panels weighing up to 1.4 million pounds each of locally sourced timber. Freres Lumber, Zip-O-Log mills, and Timberlab are involved in the project, which plans to complete in 2025 and use 3.3 million board feet of western U.S. lumber.

The 619 Ponce building’s redevelopment in Atlanta by Jamestown is using all Georgia sourced timber. The Jamestown managed timber was harvested and transported to Georgia-Pacific’s sawmill in Albany, GA where it was processed to the higher specifications for moisture content and grade needed for mass timber. Then, the lumber was shipped to SmartLam in Dothan, AL for CLT panel manufacturing. The billets were then sent to Sauter Timber in Knoxville, TN, for CNC routing of the connection joints and then delivered to the job site for StructureCraft to assemble. At the end of June, the top of the building was assembled in place, and the total building completion is expected in 2024.

We continue to watch this industry develop in North America and study the opportunities for timberland owners and wood manufacturers.

Pat Jolley, Forisk Forest Industry Analyst & Consultant, co-authored the research in this blog post.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Heather Clark at hsclark@forisk.com. For details on mill capacity and to produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database.

Leave a Reply