Pulp and paper mill closures garner headlines as they represent massive facilities employing hundreds and contributing millions of dollars to local economies. They also provide an important market for wood fiber for forest landowners and sawmills. Mill closures hamper landowners’ ability to achieve silvicultural goals where they can no longer afford to commercially thin their forests.

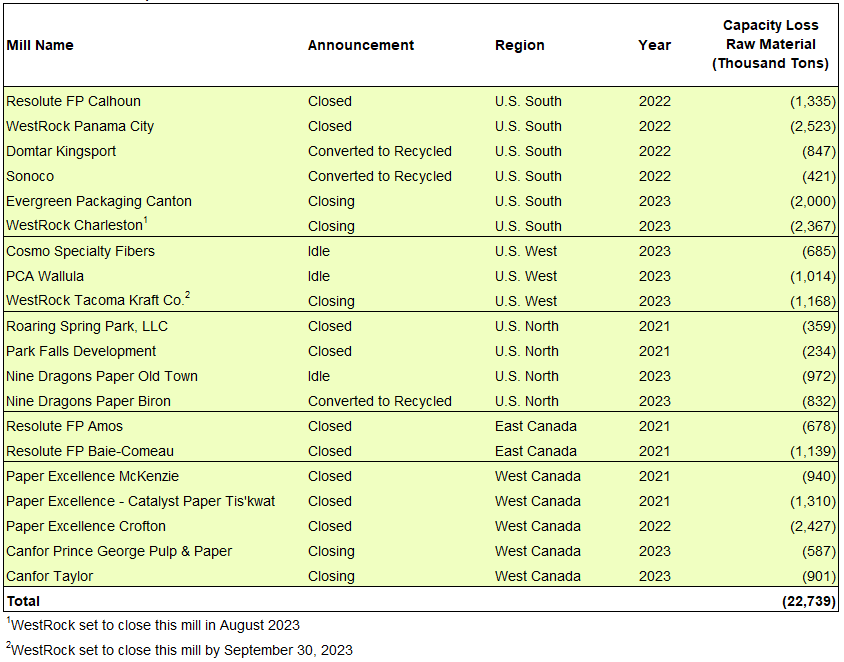

Over the past three years, closures, conversions of facilities to recycled feedstocks, and indefinite idling of pulp mills impacted all five regions we track in North America (Figure). In total, 20 mills reduced pulp fiber consumption by over 22 million tons[1]. As the largest pulp and paper producing region, consumption in the U.S. South declined most, over 9 million tons. Western Canada, with the ongoing supply constraints and lumber industry contraction, lost 6 million tons of demand, the second largest decline. Significant investment still flows into the industry, despite recycled capacity continuing to offset virgin fiber demand. We are tracking over $5.5 billion in North American pulp and paper capital expenditure over the next three years.

The industry does not operate in a vacuum, though. While wood demand for pulp shrinks, the pellet and bioenergy markets continue to grow. From 2020 to 2023, North American wood pellet capacity expanded by 4.8 million metric tons. This represents around 11.6 million tons of wood fiber. Not all pulp-quality fiber is equal, but landowners welcome any offset to falling demand.

Thanks to Pat Jolley for his contributions to this research.

[1] This excludes mills that added or expanded recycling alongside existing virgin demand or closed only portions of mills.

The Forisk Research Quarterly (FRQ) includes forest industry analysis for all major sectors, as well as timber price projections and featured research. Email hsclark@forisk.com for pricing information and to place an order.

Leave a Reply