This post introduces research and topics that will be addressed in the Q2 2024 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

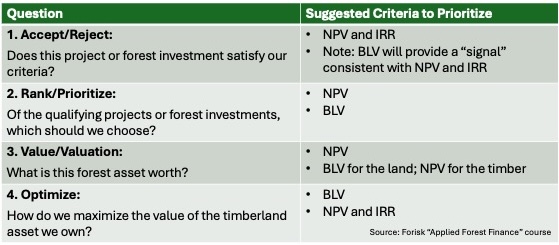

When deciding where to allocate limited capital, we benefit by systematically applying available criteria for identifying, ranking, and optimizing the available options. In the previous post (Financial Criteria in Forestry, Part I: What’s the Question?), I concentrated on how quality questions help us prioritize and clarify issues when making forest investment decisions. This post focuses on how choosing appropriate financial criterion to make those decisions depends on the question we’re asking.

Matching Financial Criteria to Forest Investment Questions

In forest finance, we apply a standard set of discounted cash flow (DCF) techniques and criteria for accepting/rejecting potential investments, ranking qualifying investments, and valuing those investments. The prioritized criteria include net present value (NPV), internal rate of return (IRR), and bare land value (BLV), all of which quantify the time value of money and investor opportunity costs. However, the relevance and clarity offered by each approach varies.

Accept/Reject

When evaluating whether a specific investment satisfies basic DCF financial criteria, metrics such as NPV and IRR, as well as BLV, will give consistent “accept/reject” signals. This is also true for marginal analysis questions related to, for example, incremental fertilizer treatments.

Observation: Applying NPV and IRR in tandem prudently deepens an analysis while improving the ability to communicate results to multiple audiences. Some folks want to see the dollars while others prefer rates of return. Since the inputs needed to estimate both criteria overlap, the incremental work is negligible.

Ranking/Prioritizing

When ranking or prioritizing those investments which satisfy the basic criteria, NPV is recommended. (In cases, BLV also works well.) While IRR yields results consistent with NPV and BLV, it is not ideal for ranking projects requiring significantly different initial investments, in which case NPV provides a valuable supplement.

Observation: If choosing from or between financially acceptable, mutually exclusive investments, and capital is limited, apply NPV.

Valuing

When valuing timberlands, appraisers rely heavily on sales comparisons (market “comps”) and income approaches. The income approach requires estimates of future cash flows based on future forest growth and stumpage prices, and the use of discounted cash flow (DCF) models and analysis which generate estimated NPVs (and IRRs).

Observation: Valuing forest land often comprises the separate valuation of the forest and the land. BLV can be used to support the estimation of land value for growing timber (though this estimate may deviate from local market values). In limited cases, timber valuation may not require discounted cash flow analysis; rather, estimating the liquidation value of harvesting all timber today may be sufficient. For this, multiply product volumes by their current local timber market prices. (That’s not a recommendation; it’s just how it happens sometimes.)

Optimal Rotation

To estimate the optimal rotation or forest management strategy, prioritize the use of bare land value (BLV). NPV and IRR also work well for a range of screening and ranking forest investment projects.

Observation: What makes BLV useful for evaluating forestry investments? BLV helps (1) identify the optimal rotation length; (2) order the forest management activities; and (3) determine whether or not to invest in specific silvicultural activities. BLV also helps us conduct marginal analysis on short-term harvesting decisions related to price “spikes” or declines in local markets.

Back in the 1990’s while running TIMO’S I required financial analysis for ever propose Silvicultural practice. The only practice that consistently met or exceed the cost of capital. Reforestation almost never did. Recently I found a few of them and, no surprise (at least to me), all the reforestation analysts over stated future prices. And, based on my experience, I suspect they Ofer under estimated the volume of lower value pulpwood, and over stated CNS and ST. So, returns we lower than expected.

The situation may be different today with investors apparently happy with sub 5% real returns.

Good summary. Thanks for putting this together Brooks.