In October, we reported in the Q4 2024 Forisk Research Quarterly (FRQ) our revised outlook for commercial timber inventory across the coastal Pacific Northwest (PNW) region. Our revised outlook for inventory over the next 10 years was generated from updates to three major components of Forisk’s western region timber supply model: 1) forest inventory data, 2) outlooks on annual mill demand for softwood sawlogs, and 3) an accounting for commercial inventory removed from the commercial growing stock due to recent forest policies enacted in the PNW region.

Recent changes in timber inventory, sawmill processing capacity, and forest policy

We collected the most recent data on historical forest inventory volume and acreage across age classes and forest types made available through the U.S. Forest Service Forest Inventory and Analysis (FIA) program. Near- to medium-term expectations of capacity changes were informed by Forisk’s mill capacity database. Our forecast of annual softwood sawlog demand is now larger than it was last year, reflecting our revised expectations of higher annual production of lumber in the western U.S. region.

The updated Forisk outlook makes further adjustments to our inventory totals to account for the impacts of forest policy. This includes the recently amended logging rules incorporated into the Oregon Forest Practices Act, based on the Oregon Private Forest Accord (PFA). The primary impacts of the PFA on private timber harvesting activity relate to logging activity in riparian areas, logging activity on steep slopes, and a restriction of logging roads on steep slopes or near riparian zones. These restrictions are intended primarily to minimize sediment in fish-bearing streams. Previous Forisk research suggests that existing logging standards and best practices legislation effectively limit harvestable sawlog inventory on private timberland by around 7% below the region-wide totals computed from FIA data. Based on conversations with industrial timberland owners and managers in Oregon, Forisk estimates that an additional 3% of the harvestable inventory will be removed from harvesting plans due to the PFA. These adjustments are incorporated into Forisk’s updated outlook. The updated outlook also accounts for the 185 thousand acres of private timberland that burned in coastal Oregon during the 2020 labor day fires.

Projections of commercial timber inventory

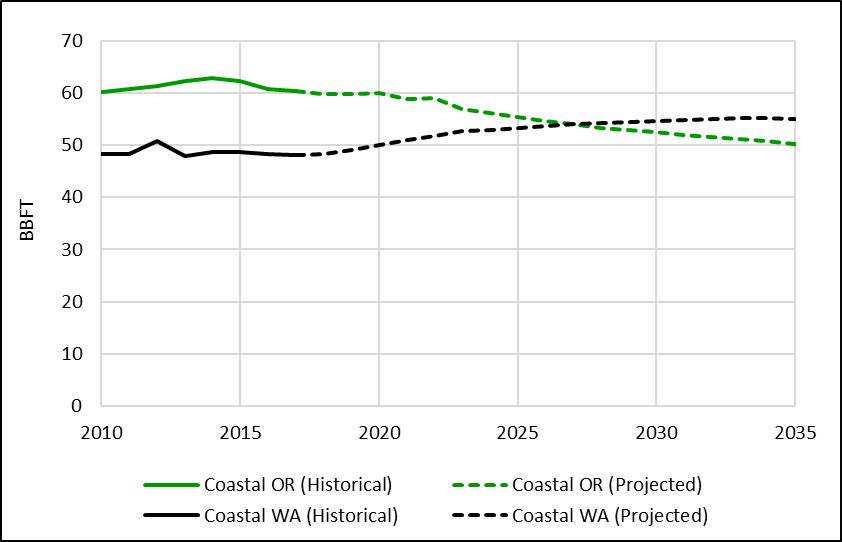

Through 2033, commercial softwood sawlog inventory is expected to fall in coastal Oregon but rise in coastal Washington. Across the entire coastal PNW region, commercial sawlog inventory is expected to fall by 2.5%, from 109.2 BBFT in 2024 to 106.4 BBFT in 2033. Oregon sawlog inventory falls below Washington by 2027, reaching 51.3 BBFT by 2033 (about 20 times annual removal volume). Inventory in Washington is projected to increase to 56.2 BBFT by 2033 (about 34 times annual removal volume).

Source: USFS (FIA), Forisk.

It is important to note that our attention on the commercial inventory only allows us to better track the relationship between changes in the available sawlog inventory and changes in delivered sawlog prices. To calculate commercial inventory totals, we have excluded in our summary of FIA data growing stock volume larger than 29” DBH, restricted our attention to only softwood sawlog grade wood available on private timberland, and subtracted inventory reserves created by forest policy. While this helps in forecasting timber prices, it does not provide a full measure of the sustainability of all forest growing in the PNW. More holistic measures of volume computed from FIA data would be needed to approximate measures of total forest growth-to-drain.

This post reports on Forisk’s Base case inventory outlook from the Q4 2024 Forisk Research Quarterly (FRQ). To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

Leave a Reply