Softwood lumber prices finally exceeded break-even levels at the end of 2024 but not before many lumber producers reduced capacity. Total 2023 North American softwood lumber production capacity was over 75 billion board feet (BBFT). North American lumber capacity increased over 1% in 2024 while the top ten producers shed almost 5% of their total capacity by shuttering 13 softwood lumber mills.

Forisk tracks over 2,300 forest industry mills, including planned capacity changes, to publish the North American Forest Industry Capacity Database and generate industry research and projections in the Forisk Research Quarterly. From the mill database, Forisk annually publishes a list of the top 10 softwood lumber producers in North America, along with notes on the year-over-year changes.

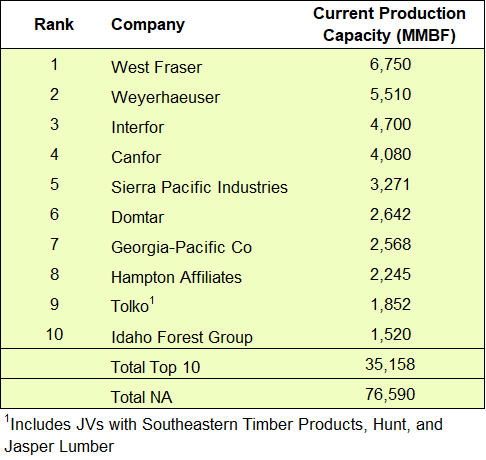

Top 10 North American Lumber Firms

In 2024, North America’s top 10 softwood lumber firms could produce 35.1 billion board feet of lumber, representing 46% of total North American capacity (76.6 BBFT). Several lumber companies reduced capacity through closing facilities or reducing production in 2024. The top ten producers remain constant from 2023 but with 1.8 BBFT less capacity. West Fraser, still the largest softwood lumber producer in North America at 6.8 BBFT of capacity, decreased overall capacity in 2024, closing four mills and completing two investments. Weyerhaeuser, the second largest lumber producer, reduced capacity by 20 million board feet (MMBF) with the closure of New Bern, NC and completing a modernization in Holden, LA.

Interfor and Canfor are the third and fourth largest lumber producers in North America after several capacity reductions throughout the year. Interfor reduced capacity by 550 MMBF and Canfor by 775 MMBF in 2024.

Data Sources: Forisk North American Forest Industry Capacity Database

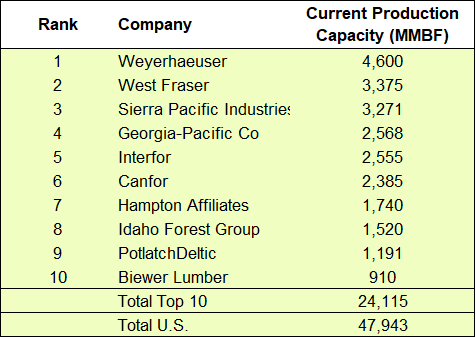

Top 10 U.S. Lumber Firms

The top 10 softwood lumber producers in the U.S. have the capacity to produce 24.1 BBFT of lumber, which represents 50% of the U.S. industry (47.9 BBFT). Weyerhaeuser tops the list at 4.6 BBFT of capacity, followed by West Fraser and Sierra Pacific Industries, at 3.4 and 3.3 billion board feet, respectively.

Georgia-Pacific gained one spot relative to 2023, to number 4 and Interfor dropped to number 5. Interfor reduced 550 MMBF of capacity while Georgia-Pacific reduced only 233 MMBF resulting in the switch.

Canfor consolidated sawmill capacity in 2024 with two closings, two expansions, one new sawmill and a capacity decrease to remain sixth on our list this year at 2.4 BBFT.

Hampton Affiliates, Idaho Forest Group, PotlatchDeltic and Biewer Lumber round out the U.S. top ten lumber producers for 2024. In 2024 U.S. top ten producers reduced 3% (738 MMBF) of their respective capacity while total U.S. capacity increased 2% (826 MMBF).

Data Sources: Forisk North American Forest Industry Capacity Database

The Forisk Research Quarterly publishes analysis of the softwood lumber sector in North America and capital investment trends. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email ndiluzio@forisk.com for pricing information and to place an order.

Leave a Reply