After peaking the past three years, softwood lumber prices finally returned to break-even levels in 2023. Poorly positioned lumber producers closed, reducing North American lumber capacity by 2% after gains in 2022 and 2021. Closures included 9 sawmills with capacities over 100 MMBF. Forisk tracks over 2,200 forest industry mills, including planned capacity changes, to publish the North American Forest Industry Capacity Database and generate industry research and projections in the Forisk Research Quarterly. From the mill database, Forisk annually publishes a list of the top 10 softwood lumber producers in North America, along with notes on the year-over-year changes.

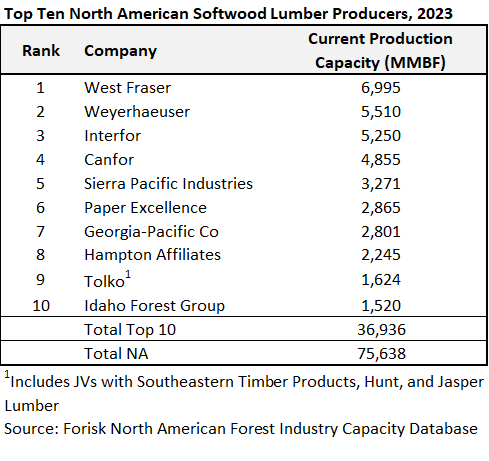

North America’s top 10 softwood lumber firms can produce 36.9 billion board feet of lumber and represent 49% of total North American capacity. Several of these companies closed facilities or reduced production in 2023. West Fraser, the largest softwood lumber producer in North America at 7.0 billion board feet of capacity, slightly increased capacity in 2023 with the purchase of the 150 MMBF Spray Lake sawmill in Cochrane, Alberta to offset the closing of the 130 MMBF Perry, FL sawmill.

Interfor is the third largest lumber producer in North America after completing an expansion in Perry, GA adding 45 MMBF. Canfor falls two spots to number 4 after reopening the purchased DeRidder, LA mill and closing mills in Houston and Chetwynd British Columbia. Paper Excellence moves into the top ten with the purchase of Resolute Forest Products, the 6th largest producer in North America.

Total North American softwood lumber production capacity for 2023 was over 75 BBFT.

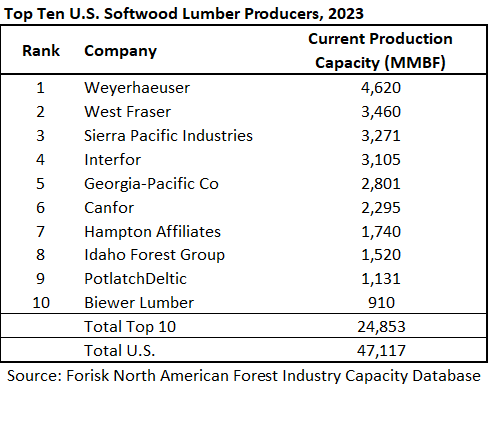

The top 10 softwood lumber producers in the U.S. have the capacity to produce 24.9 billion board feet of lumber, which represents 53% of the total U.S. industry. Weyerhaeuser tops the list at 4.6 billion board feet of capacity, followed by West Fraser at 3.5 billion board feet.

The order of the top ten U.S. lumber producers has not changed versus one year ago, though Georgia-Pacific added 70 MMBF with the modernization at Pineland, TX, increasing GP’s U.S. capacity by 3%. Hampton Affiliates lost 85 MMBF with the October 2023 news of permanent curtailment at Banks, Oregon, decreasing their U.S. capacity by 5%.

The biggest change was Canfor opening the DeRidder, LA sawmill and adding 12% to their U.S. capacity. Year end 2023 total U.S. softwood lumber production capacity is 47 BBFT.

In Q1 2024 significant capacity changes are already reported. New facilities include Hunt-Tolko in Talyor, LA and Roseburg in Weldon, NC, plus closings by Interfor in Philomath, OR, and West Fraser in Maxville, FL, Fraser Lake, British Columbia, and Huttig, AR.

The Forisk Research Quarterly publishes analysis of the softwood lumber sector in North America and capital investment trends. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Leave a Reply