This post is an excerpt from the Q3 2025 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America, and contains data from Forisk’s Wood Fiber Review.

Introduction

News of pulp and paper mill closures frequented phone conversations and inboxes the past three years. These closures reduce outlets for sawmill residual chips and pulpwood roundwood (pulp logs) for landowners. Reduced demand for pulpwood from the woods impacts timber management plans in markets with mill closures. As paper industry fiber demand shifts, we compare wood feedstock prices in the U.S. to a recycled fiber substitute: Old Corrugated Containers (OCC).

Fiber Costs

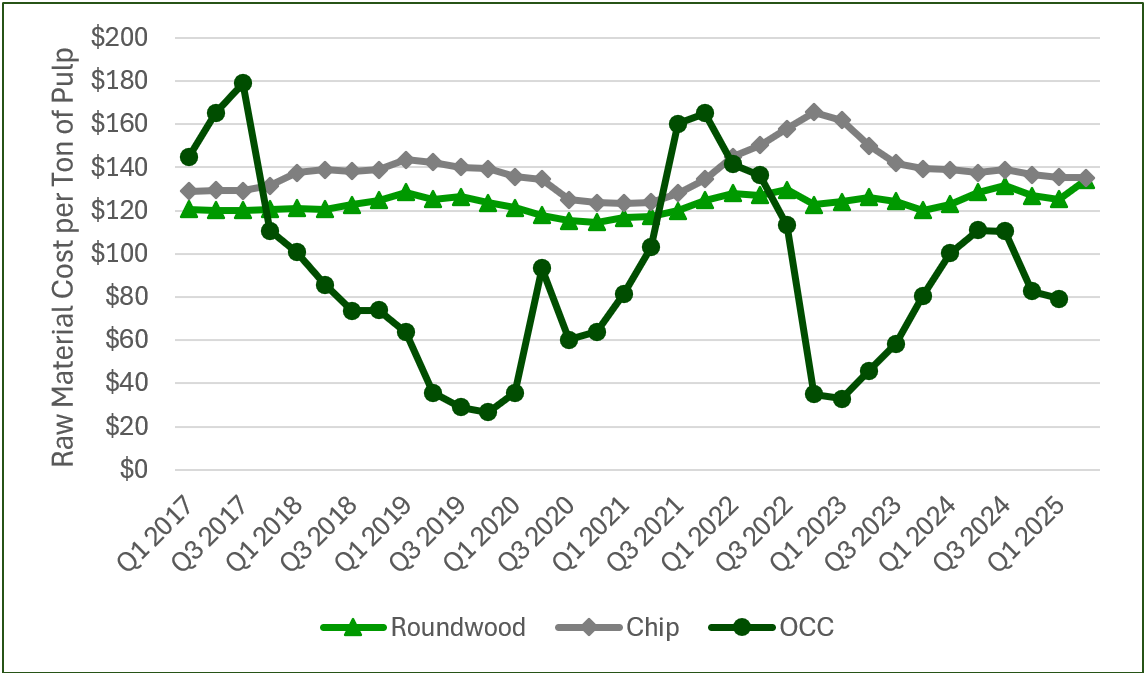

Pulp producers have a variety of feedstocks to choose from, including OCC from recycling markets, roundwood pulp logs, and residual wood chips produced in lumber manufacturing. Reporting these prices per ton of pulp produced accounts for the fact that pulp mills buy around 3.5 tons of wood per ton of pulp produced compared with a little over 1.0 ton of OCC per ton of pulp produced. Over the past eight years, wood costs for roundwood and chips have been relatively stable. OCC has been more volatile, swinging from $180 per ton of pulp produced to $27 per ton.

Figure: OCC and Virgin Fiber Prices Per Ton of Pulp Produced, U.S.

Data Sources: Forisk Wood Fiber Review, RecyclingMarkets.net

Note: Virgin fiber costs from Forisk are on delivered basis, OCC national cost data from RecyclingMarkets.net are on FOB basis.

Mill Capacity Changes

Pulp/paper companies have invested in mill capacity to use OCC and recycled materials to take advantage of lower costs. Several companies in the U.S. have converted wood-using mills to 100% recycled mills and built new greenfield mills to buy recycled feedstocks. Conversions and new builds to 100% recycled mills added 3.6 million tons of pulp/paper capacity since 2017, about 5% of current pulping capacity in the U.S. Other investments added recycled production lines to wood-using mills. This happened during a time when wood-using pulp mills closed.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com. To learn more about the Forisk Wood Fiber Review (WFR) click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply