For softwood lumber producers in North America, 2021 was a year of opportunity. Lumber prices skyrocketed in the first half of the year to unprecedented highs, then fell back to normal ranges in the third quarter. As we close the year, lumber prices are drifting up again. Lumber firms positioned themselves for strong (and volatile) markets by shifting production capacity: firms acquired mills, sold assets, and developed new infrastructure. Forisk tracks over 1,900 forest industry mills, including planned capacity changes, to publish the North American Forest Industry Capacity Database. From the mill database, Forisk produced a list of the top 10 softwood lumber producers in the U.S. in January 2021. As we close out 2021, who are the top 10 softwood lumber producers in North America and the U.S. today?

North American Lumber Producers

The top 10 softwood lumber firms in North America can produce 35.6 billion board feet of lumber and represent 48% of total North American capacity. Several of these companies actively acquired new assets this year; in total, top 10 firms added 1.4 billion board feet of capacity since January. West Fraser is the largest softwood lumber producer in North America at over 7.2 billion board feet of capacity. This includes the recent purchase of Angelina Forest Products in Lufkin, TX and expanded capacity at the Dudley, GA sawmill. Weyerhaeuser is second on the list, followed by Canfor in third place. Interfor moved up in rankings this year: it was the fifth-largest producer in January but increased nearly 1.0 billion board feet during the year to rise to the #4 spot on the list. Interfor purchased four sawmills from Georgia-Pacific this year, and purchased the Summerville, SC sawmill from WestRock. Interfor’s total excludes the pending purchase of EACOM as it has not closed yet: EACOM will add another nearly 1.0 billion board feet of capacity to Interfor’s total once the sale closes. Sierra Pacific Industries also increased in rank since January: it rose from the #7 spot to the #5 spot with the acquisition of Seneca. Georgia-Pacific fell in the rankings given the sawmill sale to Interfor.

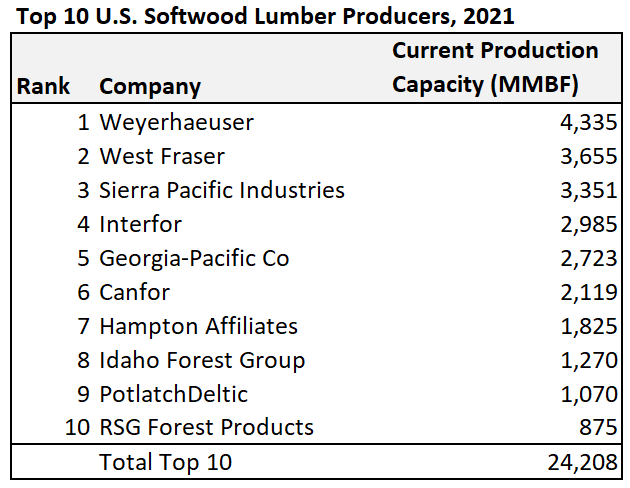

U.S. Lumber Producers

The top 10 softwood lumber producers in the U.S. have the capacity to produce 24.2 billion board feet of lumber, which represents 53% of the total U.S. industry. Weyerhaeuser tops the list at 4.3 billion board feet of capacity, followed by West Fraser at 3.7 billion board feet. Sierra Pacific Industries rose to the #3 spot this year and is followed by Interfor. Georgia-Pacific fell from #3 in January to #5 currently.

The Forisk Research Quarterly publishes analysis of the softwood lumber sector in North America and capital investment trends. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Leave a Reply