After reaching unprecedented highs the past two years, softwood lumber prices have corrected. Lumber producers shifted and expanded capacity to deploy capital and position themselves for future growth. Forisk tracks over 2,100 forest industry mills, including planned capacity changes, to publish the North American Forest Industry Capacity Database and generate industry research and projections in the Forisk Research Quarterly. From the mill database, Forisk produced a list of the top 10 softwood lumber producers in North America and the U.S. in 2021. As we close out 2022 and begin 2023, who are the top lumber producers today?

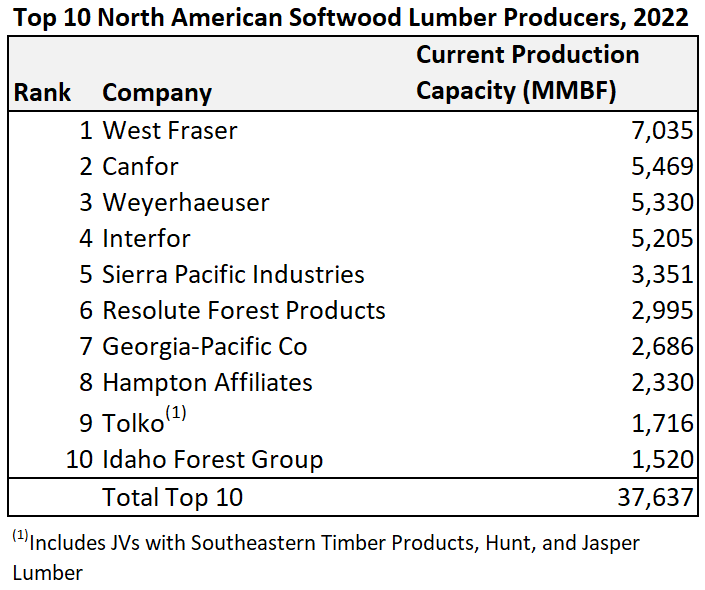

North American Lumber Producers

The top 10 softwood lumber firms in North America can produce 37.6 billion board feet of lumber and represent 49% of total North American capacity. Several of these companies actively acquired or opened new assets in 2022; in total, top 10 firms added 2.0 billion board feet of capacity. West Fraser is the largest softwood lumber producer in North America at over 7.0 billion board feet of capacity. The firm slightly reduced capacity in 2022 by permanently curtailing 170 million board feet of production at BC sawmills Fraser Lake and Williams Lake in August 2022. Also, in January 2023, West Fraser indefinitely curtailed the Perry, FL sawmill, which would reduce capacity in 2023.

Canfor rises to the #2 slot for 2022 with purchase to two sawmills and a specialty mill in Alberta, Canada from Millar Western Forest Products Ltd. Also, Canfor permanently reduced the capacity at the Plateau sawmill in BC by 150 million board feet in 2022. Interfor actively expanded capacity and grew the most of any top 10 firm. Interfor added 1.3 billion board feet of capacity (34% increase in 2022), mostly through acquisitions in eastern Canada with the purchases of EACOM Timber Corporation and Chaleur Forest Products. The company also reopened the Dequincy, LA sawmill. Hampton Affiliates reopened the former Conifex sawmill in Fort St. James, BC. In addition, Idaho Forest Group gained 250 million board feet of capacity by opening the Lumberton, MS sawmill.

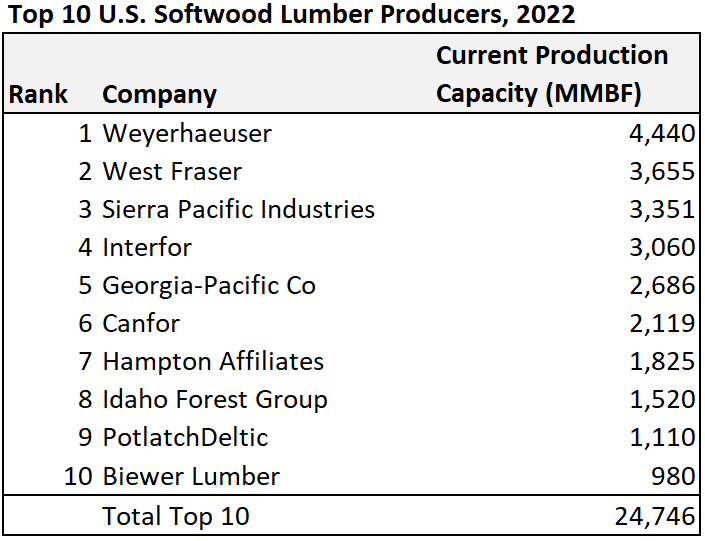

U.S. Lumber Producers

The top 10 softwood lumber producers in the U.S. have the capacity to produce 24.7 billion board feet of lumber, which represents 53% of the total U.S. industry. Weyerhaeuser tops the list at 4.4 billion board feet of capacity, followed by West Fraser at 3.7 billion board feet. Biewer Lumber is new to the top 10 list and comes in at #10 with the opening of the Winona, MS sawmill in 2022.

The Forisk Research Quarterly publishes analysis of the softwood lumber sector in North America and capital investment trends. To produce custom reports and maps, check out Forisk’s North American Forest Industry Capacity Database. Discounted rates available for companies that also subscribe to the Forisk Research Quarterly (FRQ). Email hsclark@forisk.com for pricing information and to place an order.

Leave a Reply