This post is the second in a series related to the Q1 2023 Forisk Research Quarterly (FRQ). It includes topics that will also be addressed in the (virtual) Applied Forest Finance course on May 16th, 2023.

What a difference a century can make. Forestry in the United States, one hundred years ago, featured massive wildfires, aggressive conversion to agriculture, and harvest levels exceeding timber growth. Today, while we still have wildfires, the forest sector is characterized by more intensive management and forest growth markedly exceeding harvest levels. The current timberland sector also features high levels of institutional timberland ownership.

Forisk tracks private timberland ownership in the U.S. and Canada, and our team has a special research interest in publicly-traded timberland-owning real estate investment trusts (timber REITs). In 2008, we registered the FTR (“footer”) Index to benchmark the timber REIT sector. Each week, we publish a one-page (Forisk Timber REIT) FTR Weekly [1] that compares timber REITs to other assets.[2]

The number of public timber REITs in the U.S. changed in 2022, as the sector consolidated from four firms to three when PotlatchDeltic (PCH) merged with CatchMark Timber Trust (CTT) in an all-stock transaction. (For reference, the number of public timber REITs has fluctuated between two and five since 2004. Plum Creek was the sole timber REIT from 1999 through 2003.)

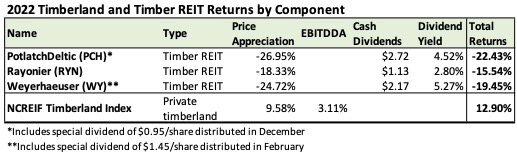

That said, how did timber REITs perform in 2022? According to the FTR Weekly, timber REITs as a sector returned -22.75% based on appreciation and -18.51% on a total returns basis in 2022 (versus 25.09% on appreciation and 30.12% for total returns in 2021). How did this compare to traditional private timberlands owned by institutional investors? Timberlands returned 12.90% in 2022 (versus 9.17% in 2021). The figure below compares the 2022 performance of the three public timber REITs to private timberlands as tracked by NCREIF.

The price appreciation for the timber REITs assumes investors bought shares on December 31, 2021 and sold them on December 30, 2022 (the last trading day of the year). The dividend yields are based on the share price upon acquisition. This year featured two special dividend distributions. In January, Weyerhaeuser declared a supplemental dividend of $1.45 per share, which was distributed in February. In December, PotlatchDeltic declared a special dividend of $0.95 per share, which was distributed later that month.

#

[1] To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please contact Pamela Smith, psmith@forisk.com.

[2] In 2008, we also published research that analyzed stock market responses to announcements of forest industry corporations converting from C-corps to timber REITs: “Investor Responses to Timberlands Structured as Real Estate Investment Trusts” by Brooks Mendell, Neena Mishra and Tim Sydor, published in 2008 in the Journal of Forestry.

Leave a Reply